At CompFidus Mentoring Ltd, we believe that knowledge is most impactful when it’s practical, relevant, and directly applicable to the challenges professionals face every day.

Our training session on “FATCA & CRS: Navigating the Complexities of International Tax Reporting,” hosted at Jupiter Corporate Services Ltd, brought together a dynamic and engaged group of professionals eager to strengthen their understanding of international tax compliance.

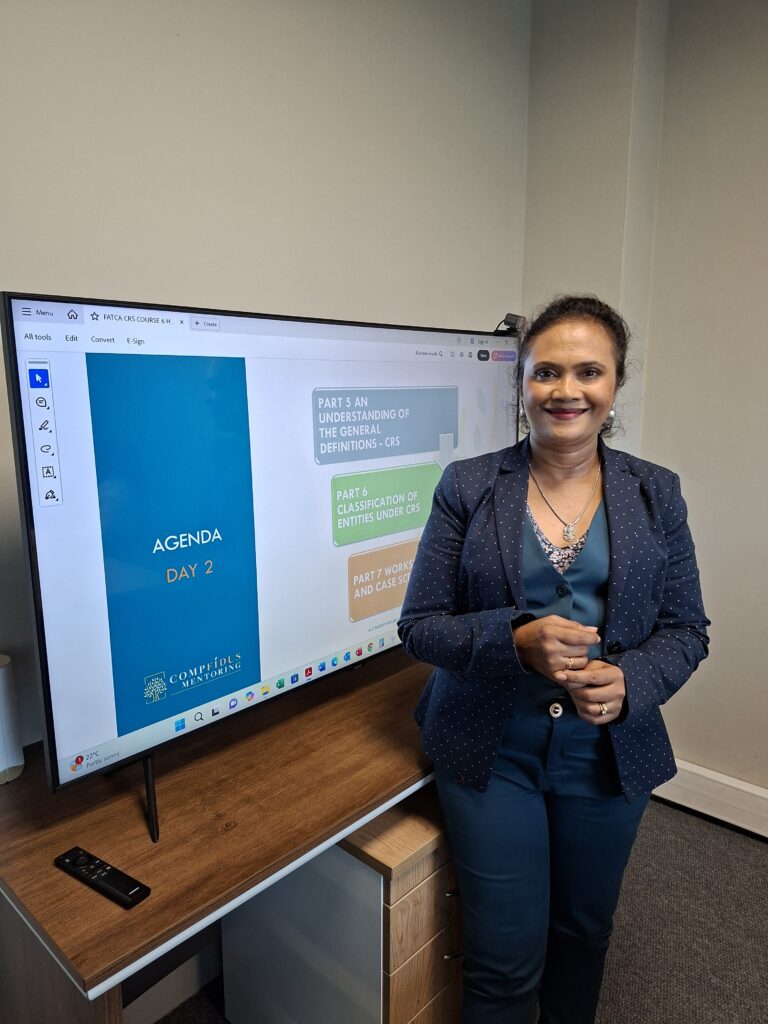

Delivered by our MQA-registered trainer, Ms. Sarika Subdhan, the session offered participants a hands-on approach to navigating key aspects of the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS).

From entity classification and due diligence obligations to reporting requirements and practical compliance challenges, the session explored real-world scenarios designed to help attendees identify risks, interpret complex requirements, and apply best practices with confidence.

Here’s a glimpse into the session!

We extend our thanks to the Jupiter Corporate Services Ltd team for their enthusiastic participation and insightful contributions throughout the session.

If your organisation is looking to enhance its team’s knowledge on FATCA, CRS, or other compliance-related areas, CompFidus Mentoring Ltd offers customised in-house training sessions tailored to your business needs.

All our courses are MQA-approved and HRDC-refundable, ensuring both quality and accessibility.

Contact us today to organise your next training!